|

So you are thinking about buying a home? Typically, people who are

planning to buy a home, and especially first time home buyers, start

by looking through newspapers ads and real estate magazines before

calling a real estate company and talking to a real estate agent. And

that’s where the problems tend to begin. As a homebuyer you must

understand that real estate agents represent sellers (they have a

legal duty to represent sellers) and not buyers (.) The only exception

to this rule is in the case of “buyer broker representation” which

I STRONGLY advise against using because it’s basically a scam

designed to squeeze money out of both ends of a real estate deal,

money from buyers and money from sellers. You see, the term “caveat

Emptor” means “buyer beware”. That means the duty to protect

your legal and financial interests in a real estate deal falls

squarely on YOUR shoulders. If you make wrong decisions, sign stupid

contracts and do less than an intelligent deal-it is your fault. In my

mind, the term “buyer beware” is a fancy way of saying “cheating

is okay”.

It all boils down to knowledge. Real estate agents are trained in real

estate principles, practices, some real estate law and some (and I

mean some) financing. How much training have you had? How much do you

know about real estate law? How much do you know about real estate

financing? What are your financial options? Are the loans being sold

to you in your best short, medium and long-range interest? These are

key questions you need answered. So here’s a few tips on getting

your bearings in the right direction before you do anything.

Number 1-Get the home financing together first! This is the singular

most important element of a real estate deal. Why? Because after the

whirlwind of emotion of your new home passes (and it will) you will

have a “mortgage monkey” strapped to your back for 15 or 30 years.

You want the best interest rate you can get but you also want the best

loan program to meet your personal needs. There are a ton of home

loans on the market; 15 and 30-year conventional loans, adjustable

rate mortgages (ARMS), Government loans like FHA, VA loans and there

are gimmick loans like negative amortization loans, nothing down

loans, etc. The point is that lenders are in the business of selling

loans- that’s right they are selling you a loan and you are paying

for it in the form of closing costs and interest rates. Nobody can get

this information together for you except you (.) You are the one that

will live with the loan and that is why you need to get your financing

together first! Our report gives you the steps you need to take to

seek out the right loan for YOU.

Number 2-Get an attorney specialized in real estate transactions (.)

People tend to see a lawyer AFTER they have a legal problem. Be

smarter than that-see an attorney first and get representation, buying

a home is a big business deal right? I cannot emphasize enough the

importance of having a lawyer to review your legal documents before

you sign anything (.) Not to hype the report but it has some tips on

this issue.

Number 3-Avoid real estate agents until you are strategically ready to

talk to them. Remember; agents are trying to sell you a property-and

they are not your agent-they are salespeople on a commission and they

have a legal duty to not only represent the seller but to get the

highest possible price on behalf of the seller. People get hurt

everyday in real estate deals and don’t even know they are bleeding.

Why? Lack of information.

Our E-Report: 101 Tips For Homebuyers, Sellers And Money Borrowers

will help you with more information regarding this article- go to

smart Books website, FREEBIES SECTION and download it for free!

Smart People Read Smart Books!

Copyright © 2006 James W. Hart, IV All Rights reserved

|

.png)

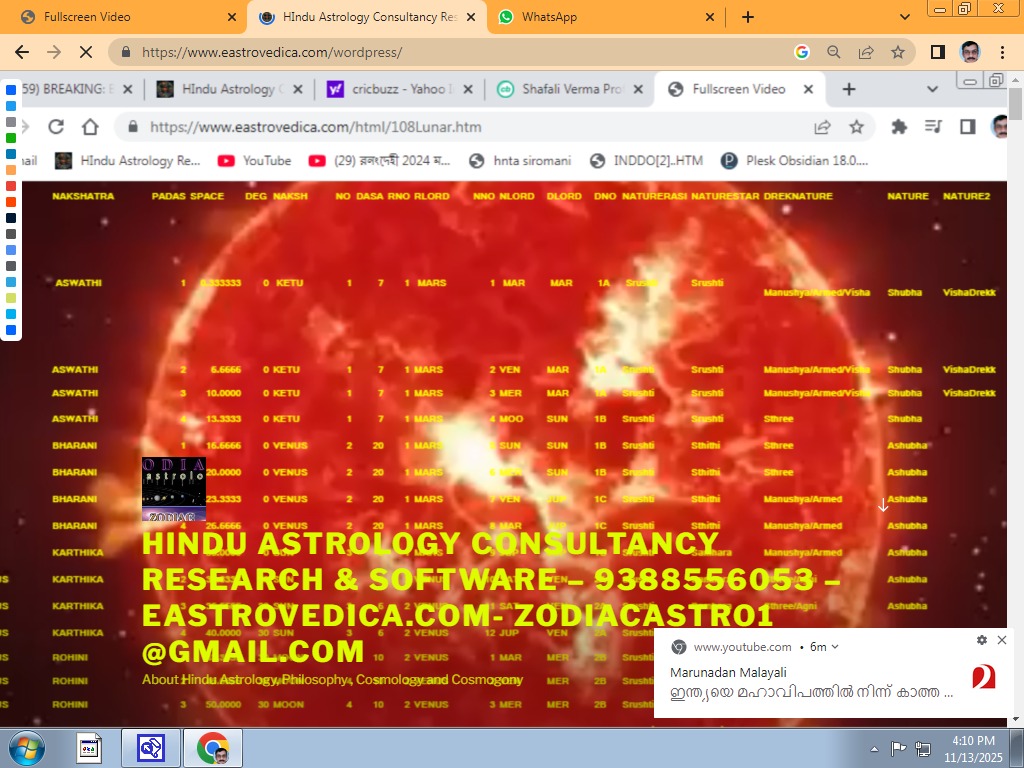

zodiacastro1@gmail.com

Ph 93885 56053 7C Shaktan Manor Apts S T Nagar Trichur 680001,

zodiacastro1@gmail.com

Ph 93885 56053 7C Shaktan Manor Apts S T Nagar Trichur 680001,